The Microfinance Lie

The 21st century seen the world change in unimaginable ways, think about all the things we have now that were inconceivable just 50 years ago; phones, internet, cheap air travel, access to the global market and so much more. In my opinion, one of the most impressive changes we've been lucky enough to experience is the decline in global poverty. A child born today has the lowest probability ever of being born into extreme poverty and the greatest chance of escaping it if they are. According to World Bank estimates in 1829 around 1 billion people lived in extreme poverty (living on less than $1.25 per day according to the updated World Bank definition) out of a total population of only 1.1 billion comparing this to 2015 where 705 million people lived in extreme poverty out of over 7 billion!

This is an outstanding change and shift and I think the main driving force of this hasn't been aid or government programs but instead global market forces have raised incomes and increased the spending and consumption of all the classes. History shows that it is those countries that industrialised and developed first were the first to escape extreme poverty. Development in India and China over the past 30 years lead to 500 million people escaping extreme poverty. Whilst growth and development are vital processes for reducing poverty however they do not build a model that sufficiently explains why some parts of the world are unable to develop. Traditional economic theory predicts that those parts of the world where there is an abundance of labour but a shortage of capital should be developing at a faster rate that the rest of the world as capital and investment should flow into these parts of the world by a sort of resource diffusion, yet this isn't happening.

However, as I mentioned there are still around 705 million people living in extreme poverty and we may not be able to rely on the market naturally lifting these people out of poverty if it has failed to do that so far. There are many tools and proposals people have to wipe out this remaining extreme poverty and I'm sure one day there will be a solution, but one of the most publicised and hyped methods is Microfinance.

The Idea

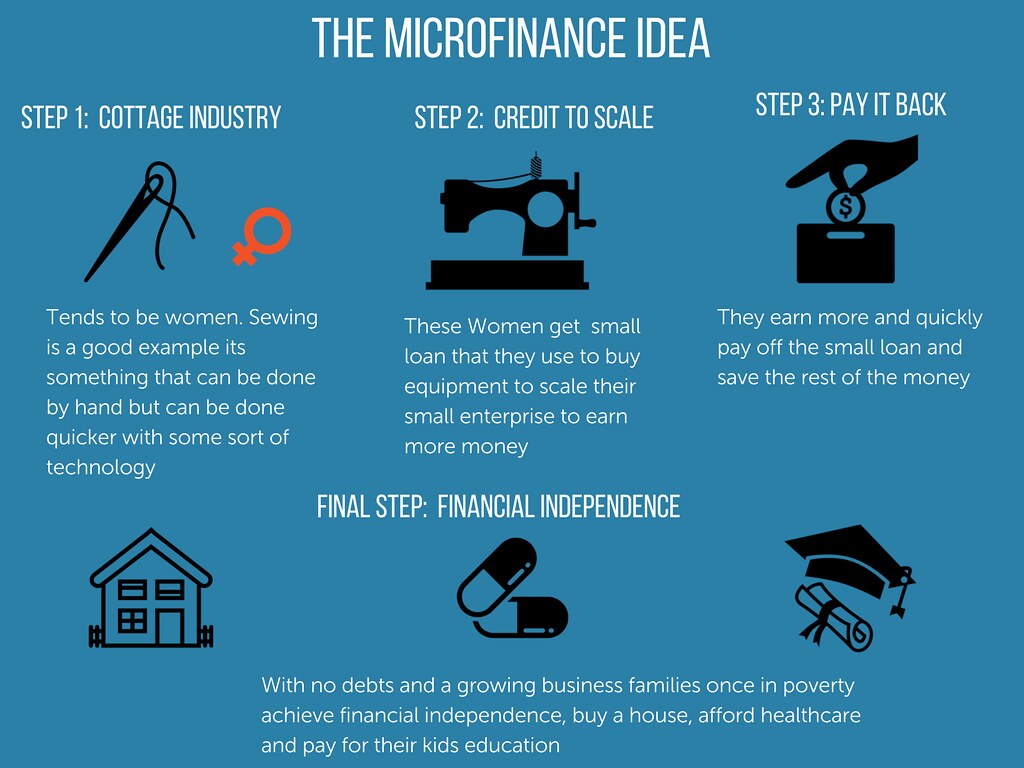

Microfinance works around the idea that people living in extreme poverty do so because they face a systemic lack of access to cheap credit and should they have access to credit then they would be able to buy the things they need start a small enterprise to make more money and lift themselves and their family out of poverty. This idea is easy to follow with a very simple example, take a small village in Bangladesh of a very close-knit community all of whom are living in extreme poverty. Regular banks will not loan to them because they are too high risk. say there is a woman in the village doesn't have a formal job but can sew which she does by hand, she occasionally fixes clothes for others and may be paid with a bartering system. Now if that woman is given a loan of $70 to buy a sewing machine she can now fix and make more clothes a service which she can sell. She quickly makes back the initial loan plus interest which she then pays off in the short term. The hope is then that this small business can help to make that woman and her family financially independent so she can buy the things they need without relying on aid or the government

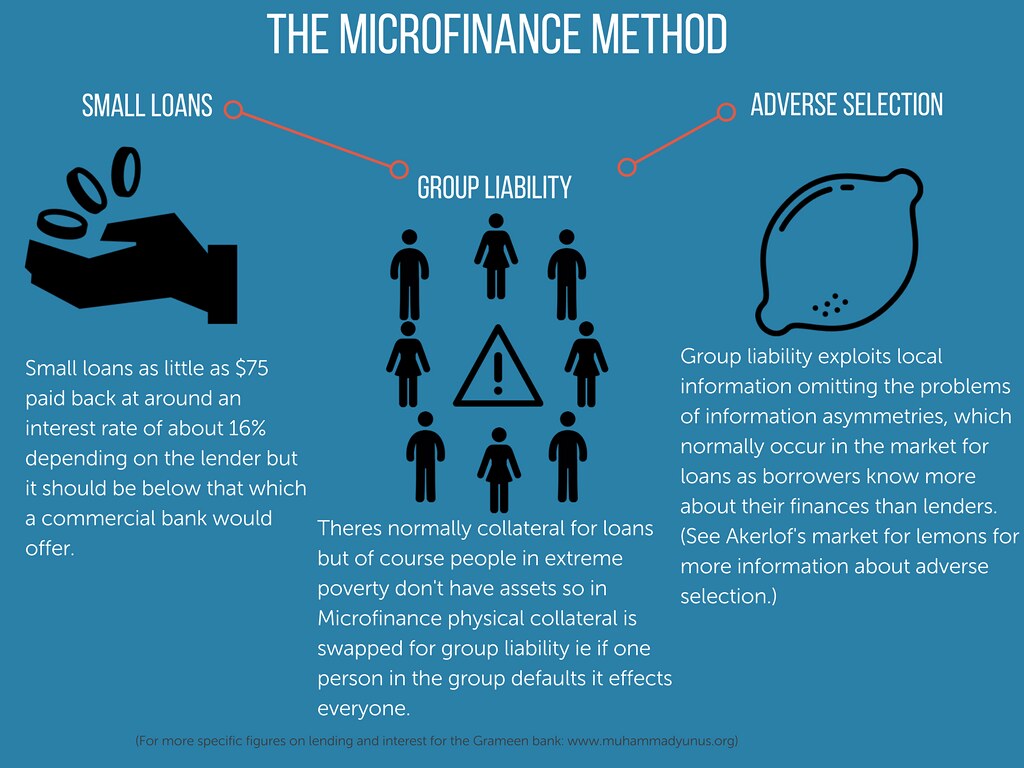

There is a lot of evidence to support the hypothesis that poor people in developing countries don't have access to credit and that both households and businesses are credit constrained and rationed (Banerjee, Duflo, Kinnan) and that despite a willingness to pay poor people are being denied credit or being priced out of the market by extortionate interest rates. To fully understand this issue we have to see it from the banks/lenders point of view, they have to assess the risk of all the loans that have and unfortunately we know the implications of giving bad loans out after the 2008 global economic meltdown. The problems lenders face is one of asymmetric information and adverse selection which is explained beautifully by Akerlof's 1970 Market for Lemons. Akerlof explains the problem of asymmetric information with a simple example in the used car markets. When you're buying a second-hand car theres no way for you to have the amount of information that the seller has about it because it's their car they know all the funny features of and most importantly they know if its a bad car otherwise known as a lemon. So the problem in this market is as a buyer you cannot distinguish between a good car and a lemon their for you have to make a calculation in your head that factors in the risk of getting a lemon which reduces the price of the good cars in the market. This applies to the market for loans, although there are people that are reliable and will pay back loans there are people who are more of a risk. The lender cannot distinguish between these people and will normally take some form of colateral (house or other assets) to mitigate this risk, people in extreme poverty do not have these assets, and it is this problem that Microfinance Institutions (MFI's) aim to fix.

The Method

So instead of taking an asset as collateral for a Microfinance loan what MFI's do is to use group liability instead. Go back to our previous example about the close knit village where the women bought a sewing machine, her loan would have been tied in with a group and if she defaults its as if everyone else in group defaults. The incentive to not default traditionally is that you'd lose your collateral now the incentive not to default comes from the social pressure not to let the group down.

Microfinance sounds undeniably good and it has received so much positive attention a UN expert on poverty statistics (Jonathan Morduch) claims Microfinance is one of the most promising and cost-effective tools in the fight against global poverty. Muhammad Yunus who started one of the first MFI's with the Grameen bank has a Nobel Peace Prize because the work he has done around Finance, there's a new post every other week from a major publication singing the praises of Microfinance. I thought it was clearly a solution when I heard it, it sounds like something that politicians could get on board with whether they were on the right or left as its all about promoting independence and market reliance. But I think in all the noise and all the excitement, not enough people are paying attention to whether or not Microfinance actually does good.

The Lie

Let us look at Grameen Bank in Bangladesh. Grameen Bank is the poster child for Microfinance and is the model that many MFI's are built upon. founded in 1983 in Dhaka by Muhammad Yunus the Grameen bank has a Nobel Prize for their efforts to create "economic and social development from below". Grameen self-reports repayment rates above 98% which is higher than most banks. In 1999 Grameen reported profits of $18 million despite actual losses of $1.5million which resulted in a write off of 3.5% of its portfolio and its not a problem for a business to make a loss its a natural part of development the problem is the sheer audacity they had to lie about it and think they wouldn't be found out. Despite this, the Grameen bank still receives constant good publicity even though they are more protective over their exact figures. If Grameen stoped considering grants from donors as part of their income and they relied solely on the income from lending and investments it would have suffered losses of $34 million between 1985 and 1996, these figures were reported by Jonathan Morduch in 1999 the same guy who claims Microfinance is one of the most promising tools to fight poverty!

I understand that different people will have different views on the issue of profits, I personally in order for a system to fight poverty in the long term it needs to generate some sort of profits to keep the incentives in place for the people providing the capital. However, I also accept that Microfinance may be viewed by others as being more closely related to charity and aid and therefore the profit of MFI's shouldn't matter. Therefore it is important to evaluate Grameen bank on their cost-effectiveness. A 1998 study by Pitt and Khandker looked at the cost effectiveness of Grameen bank by using the cost benefit ratio (CBR) which they calculated at 0.91 which means for everyone $1 gain in household consumption costs society $0.91 which does technically mean that Microfinance is more effective than just handing someone a dollar but only just. The same study compared the CBR of Grameen to that of the Bangladesh Rural Advancement Committee which had a CBR of 3.53 which is a lot worse than Grameen's and thus this is used as a justification for Grameen's existence. I think this is a really weak justification things shouldn't just be compared to nothing or something much worst but they should be compared to the next best alternative and to be honest Grameen's CBR failes to justify it being significantly more cost effective than air dropping bags of money over Bangladesh.

The claim that Grameen Bank empowers women and helps close-knit may be enough to make some overlook the flaws of Microfinance. Unfortunately there isn't enough evidence to support this, and in fact, there is a good body of evidence that MFI's are doing more harm to people than good. Despite 95% of Grameen bank loans going to women according to a study just 37% of those women remain in control of the loan because of male relatives taking primary control. A concerning consequence of group lending is that the pressure on individuals to pay can be too much for people, Andhra Padesh in India has experienced a rapid rate MFI expansion and some studies are connecting this to the region having one of the highest rates of farmer suicides, as people are being exiled from the community for failure to pay back a loan.

Conclusion

John Hatch founder of FINCA an international large Microfinance institution states 90% of Microfinance loans are being used to finance consumption, not enterprise (Beck and Ogden 2007). In our example, it means that woman with her $70 loan probably didn't go and buy a sewing machine but may have used it towards a wedding, food or clothes. This is again backed up by a study done by Banerjee and Duflo in 2013 who found that very little of each additional dollar of disposable income is spent on any form of investment or even food or shelter.

Despite Bangladesh having one of the highest levels of microcredit in the world, the country shows very few improvements in terms of economic welfare and development. Bangladesh ranked 131st in 1998 on the UN development programs human development index and had fallen to 142nd by 2014. And Bangladesh is still consistently below the global average of poverty reduction rates according to World Bank Figures. I don't think Microfinance is cost-effective or even effective in reducing poverty. I think many fundamental issues of Microfinance are overlooked because it sounds good. The programs do have the potential to promote entrepreneurial activities for borrowers but this is a very small minority and a better screening process needs to be in place to protect people from "bad" credit. As it stands the Microfinance industry is unregulated and whistleblowers such as Hugh Sinclair ("Confessions of a Microfinance Heretic" Talks at Google) are raising awareness that this is an industry that needs heavy regulation as it in its very nature targets the most vulnerable in society.

Additional reading/ resources:

- Clinton Foundation and Muhammad Yunus

- Group versus individual liability

-Akerlof's Market for Lemons

- Rural Suicides in India

If you have enjoyed reading this and want to see some of the other pieces I have written you can find me on Synap or my articles on the Synap Blog.

Comments

Post a Comment